Slow Paying Debtors Affect Cash Flow

Whether you’re a small operator or large enterprise, your clients need to pay you. This is important to any business as slow paying clients can have a negative impact on your cash flow.

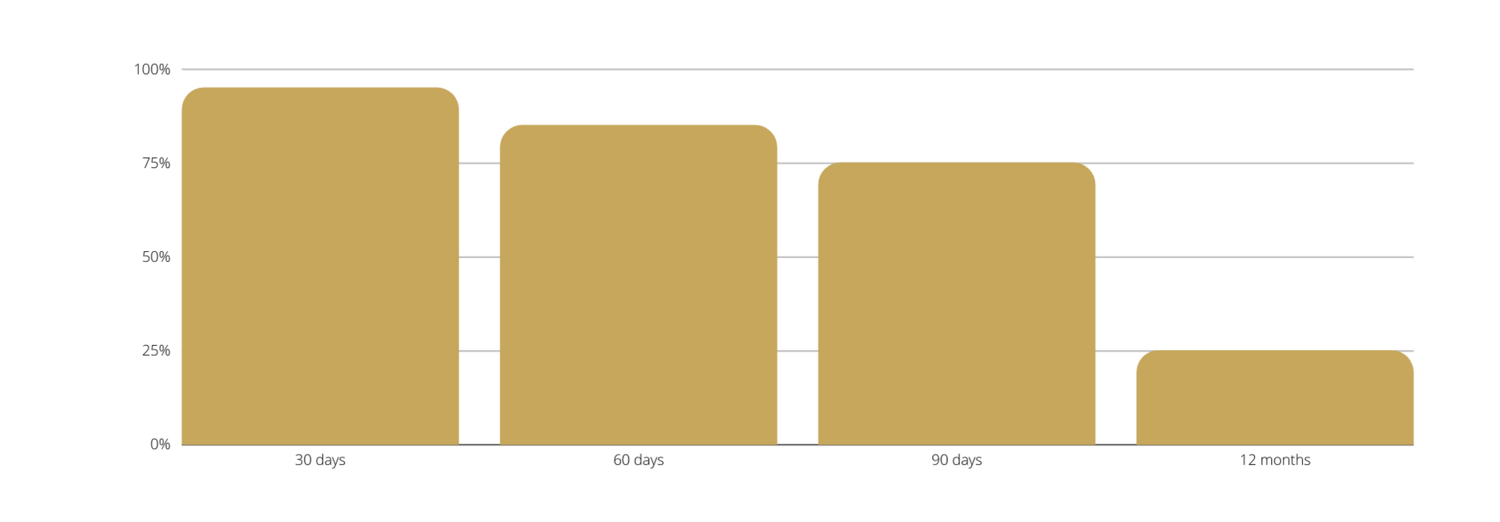

Our research shows that after 30 days 95% of bills are recoverable, and after 60 days, it reduces to 85%. The sooner you start your recovery process, the more likely a successful the outcome is

Leaving a message for your debtors isn’t working?

You have called your client, left a message with details of their outstanding debt. Surely, they’ll call back at some stage. Hopefully yes, but remember you have no control over their priorities or current financial situation.

If your tact is simply to keep calling or sending reminder emails, be aware of the worst case scenario. Friendly ‘reminders’ may be seen as annoying or harsh and could in fact have the reverse affect on trying to keep on top of your outstanding debtors.

Before you throw the toys out of the pram.

Every client relationship is different. Systems are in place, you have all their details and have provided a new and up to date T&Cs with your invoice. Did you take the opportunity to understand their business a little more prior to the engagement? This doesn’t mean they can pay in 3 years time, maybe you need to look at payment options or a plan to ensure you receive your money.

There’s not a hard right or wrong definition for when you should engage with a debt recovery agency, but there is an opportunity to have the conversation .. without cost to your bottom line.

It’s hard to provide a hard yes or no answer as to when you need help collecting money or recovering your debt. All relationships and business agreements differ, some are quite formal and others, a little more relaxed depending on the individual relationship.

Effective cash flow management comes down to a combination of sensible payment arrangements and effective debt recovery processes. Doesn’t sound like you? That’s where we step in.

Check your agreement (if this exists) to understand what your terms for payment were. Are they past due?

Determine how long your debt has been outstanding. Have you made an attempt to remind the debtor of their outstanding payment?

- You may be 2 or 3 phone calls away from giving up. Chasing up debts internally can be stressful for any workplace. It may be time to take the emotion out of the relationship and hand over to debt recovery specialists, Thoroughbred Recoveries.

- Listen to your clients prior to finalising the engagement. Do they have non-standard payment requirements?

- Make contact to provide a friendly payment reminder prior to due date

- Make a phone call first, then send an email confirming the conversation

- Make sure you have all the details for sale, due dates when calling so you’re prepared and not fumbling around. They may ask for a copy of the outstanding debt.

- Maintain regular contact with your clients, build relationships so it doesn’t feel like such a huge deal if you have to call to follow-up on a late payment which may simply be an oversight.

- Persistent without being annoying or causing issues for future dealings

- Take notes from the phone call so you don’t ask the same questions when chasing the next time.

- Ask clearly when they will make the payment and how.

- Ask us!

Don’t set yourself up for failure, make sure they can pay!

If you have any enquiries, we are here to help. Contact us on (02) 9196 8955 or email office@thoroughbredrecoveries.com.au.